|

Log in to view and manage your retirement benefits

|

|

New Life Personal Investment Plan |

Welcome to Wespath

A message from Rev. Dr. James F. Miller

Executive Director, Department of Retirement Services

A message from Andrew Q. Hendren

General Secretary/CEO, Wespath

| Read a message from AME Church Senior Bishop Adam J. Richardson Jr. |

Wespath is a not-for-profit administrative agency of The United Methodist Church (UMC) and responsible for the general supervision and administration of the retirement, health and welfare benefit plans, programs, and funds for more than 100,000 active and retired UMC clergy and lay employees for over 100 years. Wespath currently serves several expressions of the Methodist faith.

Wespath’s mission of Caring for Those Who Serve extends to all AME Church participants, helping you build the financial future you imagine, providing timely, comprehensive information about your plan and the resources you need to thrive right now and into the future.

|

Important Steps To access your New Life PIP account and review your information for accuracy, please complete the following steps:

|

|

Learn About Your Plan |

As part of the New Life PIP administered by Wespath, you receive:

- Online access to account information, tax forms and election forms in Benefits Access (www.benefitsaccess.org).

- Updated information about the performance of your investments.

- Knowledgeable Wespath Customer Service representatives to answer your questions about Benefits Access or your New Life PIP account.

- Support with financial decision making through EY Financial Planning Services.

|

Your Plan Contributions

According to The Doctrines and Discipline of the African Methodist Episcopal Church, contributions are made by the church during Annual Conferences and planning meetings. An additional contribution is made from the General Conference. You also have the option to make personal contributions to the plan. These contributions are displayed separately in Benefits Access and in your quarterly statements:

- Non-matching: 12% of your annual compensation per year with a minimum of $624 per year, as provided by the Annual Conferences. Additional voluntary contributions will also be managed in this subaccount.

- Discretionary: annual contribution from the General Conference that is determined each year and distributed among active clergy accounts.

- Personal: a contribution deducted from your paycheck.

You are immediately 100% vested in the New Life PIP.

Investing for Your Retirement

By default, all AME Church participant account investments are managed through Wespath’s LifeStage Investment Management service. This service automates the investment of your account based on your risk tolerance and other key information.

At first, your risk tolerance is set at “moderate." You can modify this in Benefits Access (www.benefitsaccess.org) under Retirement – Accounts – LifeStage Investment Options.

Changing your risk tolerance will change how your account balance is distributed among the funds—otherwise known as your target investment mix. When you change this election, the changes will be reflected in your account the following day. Any new target investment mix will impact how any future contributions are distributed among the funds.

If you prefer, you can self-manage the investment of your account balance. Log into Benefits Access (www.benefitsaccess.org), and make this change under Retirement – Accounts – LifeStage Investment Options.

Distributions

Distributions from your New Life PIP are available upon leaving service, retirement, disability or death. You can choose from the following options:

- LifeStage Retirement Income—a distribution management service that uses your New Life PIP account balance to create monthly retirement income payments designed to last for your lifetime.

- Cash installments—you decide how many time periods you want your balance to be spread over.

- Partial distributions—take part of your balance and leave some for later.

- Single lump sum distribution—take your entire balance.

| Back to top |

|

Access and Manage Your Plan |

Benefits Access (www.benefitsaccess.org) offers online access to your account information, and provides essential tax forms, statements and much more.

New User Registration

Set up your Benefits Access user account by clicking the “New User Registration” button.

|

Enter your information so we can verify your eligibility. |

|

|

Follow the prompts to set up a secure authentication process for your log-in. |

|

|

Respond to the email sent by Wespath to confirm your email address. |

|

|

Set up your secure username and password. |

Review Your Information

Once you’re logged in, it’s very important to review ALL of your personal and plan information. Be sure to verify the following:

|

Personal Information |

Benefits Access Location |

If Changes are Needed |

|

Name Date of Birth |

Under the Account Management Summary (either click your name in the upper right of the header banner or select Retirement – Profile – Account Management Summary) | You can use this form to change your personal information. Proper documentation is required. |

|

Physical Address Email Address |

Under the Account Management Summary (either click your name in the upper right of the header banner or select Retirement – Profile – Account Management Summary) | You may make these changes directly in Benefits Access (benefitsaccess.org). |

|

Your Episcopal District Your Annual Conference |

Service and Compensation Summary: select Retirement – Profile – Service and Compensation Summary | Please contact your AME Church District Representative. |

Your Participant Number

At some point, you may need to provide your participant number during a conversation with a Wespath representative or your District Representative, or if you use EY Financial Planning Services. You can find your participant number in Benefits Access at Profile – Account Management Summary.

| Back to top |

Questions about these contributions should be directed to your Episcopal District Representative.

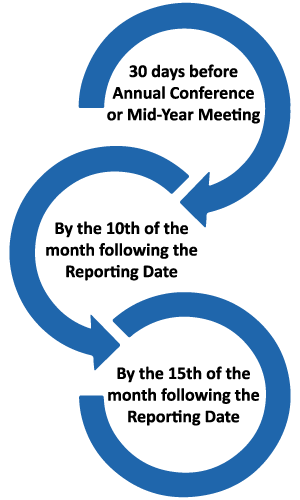

The AME Church and Wespath have developed a streamlined process to collect your retirement contributions:

Process for Non-Matching and Personal Contributions

The Local Church will:

- Send contribution amounts to the Episcopal District (or Presiding Elder based on the Bishop’s guidance)

- Submit payment to the Episcopal District Bank Account by the end of the month

The Episcopal District will:

- Reconcile contribution amounts and funds received

- Upload contribution amounts to Wespath system

- Schedule and complete fund transfer

The Participant may view the contributions.

Discretionary Contributions will be posted by December 31st of each year.

As a sustainable investor, Wespath incorporates consideration of environmental, social and governance (ESG) factors in our investment decision-making and aspires to make a positive impact on the environment and society.

Wespath’s uncompromising investment approach seeks competitive performance, aligned with our sustainable investment vision. We achieve this through an investment philosophy rooted in long-term perspective, diversification, active management, and sustainability. Wespath offers investors a suite of broadly diversified, daily priced commingled funds that invest in carefully selected, world‐class multi‐strategy firms and boutique specialist asset managers from around the globe.

News and announcements about the markets and Wespath’s investments.

Track Your Investments

Benefits Access provides comprehensive tools to monitor your investment fund performance, detailed descriptions for Wespath’s funds, and information about your investment allocations.

LifeStage Investment Management

New Life PIP participants are automatically enrolled in LifeStage Investment Management1, a service that allocates your account balance among a selection of Wespath’s investment funds to create a target investment mix based on your Personal Investment Profile. Your profile contains information about your risk tolerance, whether you qualify for Social Security benefits and other factors, including your age. You can change your risk tolerance in www.benefitsaccess.org.

Each quarter, LifeStage Investment Management compares your target mix with your actual mix of investments, which can change due to market fluctuations. If there is a significant difference, the service automatically rebalances your current investment mix and future allocations.

Whether LifeStage Investment Management is right for you depends on your personal preferences, and the amount of time and effort you’re willing to spend on managing your account.

Self-Managing Your Account

If you want to have more control in managing your investments, or if you have unique financial circumstances, you may prefer a more hands-on approach. You can opt out of LifeStage Investment Management and self-manage your portfolio by making your own elections in benefitsaccess.org. Read more information about Wespath's Investment Options.

You may wish to work with a financial professional who can help you manage your retirement plan investments. Beginning January 2023, eligible AME Church participants eligible participants can receive financial planning assistance at no additional charge from EY Financial Planning Services.1

1 Costs for these services are included in Wespath’s operating expenses that are paid for by the funds.

With Wespath, you have access to resources to help you with the information and guidance you need to make the most of your plan.

Benefits Access (www.benefitsaccess.org) contains resources for managing your New Life PIP and updating your information, as well as helpful educational resources to boost your financial well-being now and into the future. Benefits Access provides the full picture with the following resources:

- Retirement Details — See where you stand today with account balances, transaction history, investment returns, investment allocations and more.

- Retirement Projections — Estimate your retirement income and learn how to improve your future finances.

- Investment Management — Choose how you want to invest your current account balance(s) or future contributions or automate your investment selections and account rebalancing with LifeStage Investment Management.

- Distributions — Determine your retirement plan withdrawals/distributions and review options for automating your plan distributions in LifeStage Retirement Income.

- Information Updates — Update your account beneficiaries and personal contact information.

- Learn — Complete information about your retirement plan along with educational resources about Benefits Access, investing, financial planning and more.

EY Financial Planning Services is available at no additional cost* to active participants with a Wespath account balance, surviving spouses with an account balance and retired and terminated participants with account balances of at least $10,000. EY financial planners can help evaluate your financial situation and address your questions about retirement planning and investment management. They have special training in Wespath-administered plans and other topics important to participants. EY financial planners do not sell investment or insurance products. This means you receive unbiased guidance without any of the sales pressure you might have with other financial planners. EY offers confidential, comprehensive financial planning for every age and every stage of ministry.

Wespath representatives are available to answer your questions about the New Life PIP at 1-800-851-2201 business days from 8:00 a.m. to 6:00 p.m. Central time. Your District Representative or the Department of Retirement Services can also assist you with the plan and contribution information.

*Costs for these services are included in Wespath’s operating expenses that are paid for by the funds.

| Back to top |